Market Trends

Informa works in a range of specialist markets, providing customers with relevant, quality and timely knowledge and connections that help them learn more, know more and do more.

From Pharma to Consumer Retail Banking, Licensing to Artificial Intelligence, Maritime, Education, Psychology, Aviation, Medical Equipment, Health & Nutrition, Cybersecurity, Infrastructure, Biotech and more, our markets tend to be international, dynamic, growing and areas where being informed on the latest trends and closely connected to experts and customers is critical.

We have many colleagues who are experts in these markets too. Here, some of those colleagues give their insight into the latest market trends.

this is a test

- Artificial Intelligence

- Life Sciences

- Consumer Retail Banking

- Pharma Ingredients

- Asia

-

Endless opportunities

Artificial intelligence (AI) is entering a new growth phase, driven by the convergence of three trends: more data, faster hardware and better algorithms. Together, they are accelerating research, development and commercial investment in AI applications at lightning speeds. Many organisations are scaling from pilot deployments to full-scale, enterprise rollouts of AI technology within months, rather than years. Tractica forecasts that worldwide annual revenue generated from the direct and indirect application of AI software will increase from $5.4bn in 2017 to $105.8bn by 2025.

The breadth and velocity of the AI market have, however, led to increasing challenges for both technology adopters and suppliers, in maintaining the same pace of innovation with their products and integration plans. AI’s manifestation will shift alongside other technology macro trends: it is not the only show in town. Numerous other technologies, including the Internet of Things, augmented reality, virtual reality, blockchain, renewable energy, genomics and 3D printing will influence AI’s development, adoption and regulation.

Developing use cases

As the creation of data continues to increase exponentially and customers’ expectations of AI technology shift, companies must navigate the hype, adopt new capabilities and adapt their strategies, all while demonstrating improved efficiencies and generating new revenue streams.

Broadly, all AI falls into three macro categories: big data, vision and language. Although most people think of it as being driven by big data analytics, the larger growth opportunity is related to vision and language perception capabilities.

For end-users, AI interactions like robotics or autonomously moving machines are obvious, even tangible. But looking at other use cases, profound opportunities lie in forecasting, empirical decision making, operations automation, product optimisation, new business models, greater access to services, targeted services, enhanced user experiences and even improved environmental and public health. Simultaneously, AI poses many urgent challenges, from data privacy and re-skilling workforces to uncharted legal and regulatory questions.

Human interactions

AI currently has a complex relationship with humans that will change over time. While certain jobs will become automated, AI is more often poised to augment human labour and decision making. Longer term, many applications will be designed to empower humans with non-human capabilities, memory, experiences and knowledge. Various ethical, philosophical, cultural, societal and business norms will be forced into reassessment.

The jury is still out regarding the ability of machines to seamlessly interact as a human would. While social media bots have effectively passed for Twitter and Facebook users, neither robots nor virtual digital assistants can disguise their code-based composition. Another area to consider is how companies are deploying AI to power virtual agents for consumer facing interactions. They must balance unprecedented opportunities for personalisation with significant risk of failure, faux pas or backlash.

Fragmented maturity

Maturity and the metrics for success in AI vary widely from application to application. Relatively low stakes applications, such as movie recommendations, are widely accepted and used, while others such as credit scoring or medical treatment recommendations remain regulatory grey areas and face significant barriers to widespread adoption. But AI applications mark the next evolutionary step in digital transformation. Computing, sensing, networking and data generation were only the beginning. The ability to process data more quickly and intelligently across systems, leveraging hardware, sensors and cameras, and to digitise language itself, marks the next era of enterprise transformation.

Clint Wheelock, Managing Director Tractica, Informa

-

Clinical thinking

The Life Sciences industry enters 2019 with cautious optimism amid a great deal of change. Biotech innovation is booming, exit markets are robust, and new drug classes are emerging and gaining regulatory approval. At the same time, Western companies face increasing competition, the political and regulatory climate is mixed and the economics of healthcare remains a challenge.

Investment and consolidation

Innovation is moving fast, particularly in the US, where venture capital continues to pour into biotech companies in areas such as oncology, genomics and chronic diseases. In 2018, US Life Sciences firms reached a decade high in venture capital raised, while their European counterparts saw a smaller-scale increase.

Mergers and acquisitions surged in the past year, with 150-plus transactions worth a total of $148bn in disclosed deal values among therapeutics, diagnostics and medical device companies. The consolidation trend is hitting major players in pharmaceuticals and biotech. Bristol-Myers Squibb’s $74bn buy-out of Celgene, a merger of two oncology drug giants announced in early 2019, will impact research, development and drug pipelines worldwide.

Regulatory approvals

The drug industry continues to see an upswing in regulatory approvals, with the US Food and Drug Administration approving 59 new drugs in 2018, up from 46 the previous year. The European Medicines Agency approved 42 new active substances, up from 35 in 2017.

Meanwhile, regulatory changes in China have made it easier to develop drugs and get them approved for the fast-rising domestic market. China recently approved a drug developed by Western companies, an anaemia treatment from AstraZeneca and Fibrogen, before any other country.

Recent US drug approvals of note include the first-ever RNA interference drug; the first-ever cancer drug that targets a genetic fingerprint instead of a tumour’s location; and a new class of migraine medication. Conversely, despite breaking new ground, CAR-T immunotherapies for blood cancers have had mixed results commercially.

Progress in approvals should continue in 2019, with key clinical results expected to impact public health for years to come. After much hype and discussion around safety and ethics, the first clinical trials of CRISPR gene-editing therapeutics are slated to begin in the US. New drugs for neural disorders, such as depression and schizophrenia, are poised to receive regulatory approval, while novel approaches to Alzheimer’s and neurodegenerative diseases face crucial tests in patients.

Rising prices

Software and analytics are playing an increasing role in industry progress. Life Sciences companies continue to apply AI techniques, particularly in imaging, pathology and diagnostics.

Digital therapeutics have emerged, with regulatory approvals granted for new kinds of software to treat addiction and other disorders. Amazon, Microsoft and other tech giants are moving deeper into health, making advances in areas such as healthcare delivery and infrastructure.

The high cost of healthcare remains a difficult issue. Tension over rising drug prices is mounting, and biotech and pharma companies are preparing for new legislation. The US Government announced policy proposals to lower drug prices but the immediate future is unclear. Meanwhile, drug companies and insurers are signing more outcomesbased agreements, which tie the payment for a drug to its performance in patients. Drug makers have touted these approaches to control costs, but they might only be useful for a small group of drugs.

With some uncertainty in the regulatory environment, Life Sciences companies expect to save more of their cash in the short term, even as they navigate the substantial opportunities ahead.

Gregory Huang, Xconomy Editor in Chief, Informa Connect

-

Digital payoff

The global banking sector is in good health, with assets, profitability and capitalisation all having materially increased since the global financial crisis. Add the prospect of rising interest rates and relaxed regulatory pressures, and the retail banking industry appears in better shape than it has been for some time.

The landscape is changing, however. Technology, demographics, customer expectations and new competitors are forcing traditional retail banks, credit unions and mortgage lenders to change their business practices to avoid being left behind.

Forces of technology

Digital banking has transformed the way bank services are delivered and consumed. Bank of America announced in 2018 that, for the first time, deposits made through smartphones and tablets outpaced those made through branches.

And according to EY, 85% of banks say that implementing a digital transformation programme is a near-term business priority. The investment in technology to drive efficiency, manage evolving risks and capture growth opportunities will be critical for sustainable success.

The emergence of non-traditional disrupters means banks, credit unions, mortgage lenders and insurers have been forced to turn to big data, machine learning and advanced analytics to offer more directed product placement and capture new customers. Underpinning these goals and challenges is the need to make investment decisions based on real-time, granular data. The appetite for this type of intelligence varies depending on the size of the institution: larger institutions have developed sophisticated analytics while smaller ones require a synthesised view.

The traditional model of keeping all data in-house is being turned on its head. Peer contributed data exchanges are being formed across the financial services world and having access to this data will give retail banks important insights on price elasticity, market share, revenue enhancement, cost containment and more, helping them make better investment decisions faster. Open Banking in the EU, a regulation that allows the use of open application programming interfaces (APIs) to enable third party developers to build applications and services for banks, is a clear example of how this data and technology transformation is having a direct impact.

-

Demographics and customer expectations

Ensuring the best customer experience in the multi-channel world of brick and mortar branch, online and mobile banking is critical. The emergence of non-traditional banks is driving market opportunity as innovative, fast-moving lenders like Quicken, Freedom Mortgage, PennyMac and Nationstar have rapidly taken share from traditional mortgage banks. Quicken surpassed Wells Fargo as the single largest mortgage originator in the US, largely due to its customer experience.

Consumer loyalty to big bank brands has diminished and satisfaction with mobile and online functionality has decreased. Only 28% of US consumers say the experience they receive from their bank’s branch, online and mobile channels is seamless, according to Accenture.

New competitors

Consumers are willing and desirous to transact digitally, and nimble non-banks like Quicken have used technology to enhance the customer experience and reduce costs. Innovative fintech companies like Blend promise to make transactions faster and more consumer friendly, especially in the face of new regulations. These technologies offer the potential to jump ahead of incumbents with lower costs and superior customer experience.

The net result is that traditional models face significant margin pressure and must adapt or risk being left behind. And this is happening across lending, with companies like SoFi using these technologies to disrupt student lending, personal loans and other markets as well.

As consumers are forever wedded to their smartphones, the banking sector has changed forever. Matching attractive rates with the speed and execution of world-class, multi-channel customer experience are table stakes for retail banks worldwide.

Craig Woodward President, Financial Intelligence, Informa Intelligence

-

Recipe for growth

The global pharmaceutical ingredient, processing and manufacturing market continues to mature, with the start of 2019 heralding significant acquisitions and major product announcements. Businesses in emerging markets like China and India are shaking up supply chains and bringing scrutiny from regulators and customers

Acquiring to stay ahead

Our CPhI Forecast predicts continued consolidation through mergers and acquisitions of startups. Larger companies will use their scale to bring these startups’ new technologies, biologics and drug delivery methods to market; recent notable acquisitions have focused on the development of cancer fighting drugs and the continued growth of biopharma and biotech.

These trends suggest that if large pharma companies want to keep filling their drug development pipelines, they will need to innovate through acquisition and continue to bring new technologies under larger research and development (R&D) budgets.

A question of trust

In order to meet the growing demands of ageing populations, global R&D investment is forecast to reach over $183bn by 2020. While R&D continues to be focused in Europe and the US, China and India are making large investments, including in large molecule biologics, and increasingly not only to support the global market but the domestic market as well.

The fastest-growing pharma countries realise the importance of increasing their reputation as reliable, reputable and transparent markets. According to the latest CPhI Report, published in October 2018, a survey of more than 2,000 industry professionals found that India and China were the countries whose reputations had increased the most in the previous 12 months.

Flattening supply chain

While the Pharma industry is facing scrutiny from regulators and the media, the pharma ingredients market is facing pressure for transparency, traceability and efficiency in production, pricing and delivery. However, with markets including China and India gaining industry trust and scale, the supply chain for active pharmaceutical ingredients is flattening.

As companies from emerging markets mature in this flattened supply chain, there is a growing expectation for them not only to meet the needs of the clients they are supplying but also to adhere to strict US Food and Drug Administration and European Medicines Agency regulations, to ensure they can reach consumers across the globe. The result is a growing need for pharma ingredients, contract services and packaging providers to develop strategies that work not only regionally but globally.

With the supply chain becoming more closely controlled, integrated pharma supply companies have an opportunity to offer multiple services and solutions, from contract and lab services to sales. But everyone, from pharma companies to healthcare providers, needs to be able to trust the effectiveness of the process and of the end products.

Digital future

The drug delivery and packaging market is becoming highly competitive and is focusing on drug delivery innovations that meet efficiency standards and demand from digital healthcare systems.

The packaging community in particular has been investing in digital solutions, with innovations and research helping to bring new delivery methods to consumers, as well as new ways to track usage, dosage and efficiency. These digital offerings complement the overall trend of digitisation within healthcare, from patient records to drug usage, that will continue to offer opportunities for the pharma ingredients market.

Adam Andersen, Group Brand Director, Pharma, Informa Markets

-

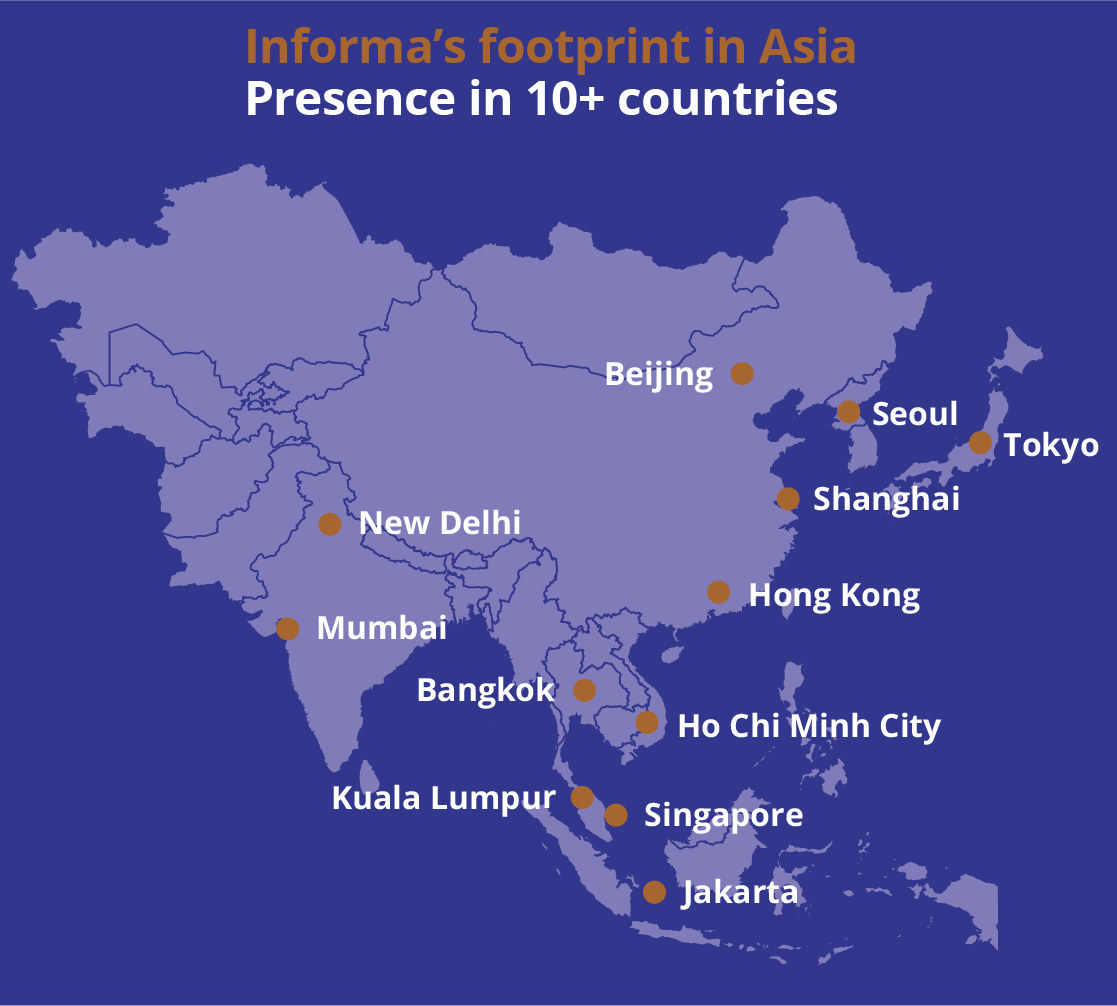

Diversity and growth

While Asia is by no means a homogenous region, there are several business and economic trends common to a number of Asian markets, which make it an exciting place to do business and find commercial opportunities, particularly in exhibitions.

Countries such as China, India and Vietnam are growing at a much higher rate than the rest of the world as their economies develop and mature, with China’s GDP growth hitting 6.9% and India’s nearly 6.7% in 2017 according to the World Bank, compared with 3.1% globally.

Asia is also home to three of the five most populous countries in the world, creating large consumer markets for businesses to target. According to IATA’s 2018 data, Asia-Pacific recorded the largest year-on-year increase in international aviation traffic of any region, and India’s domestic market for air travel posted the highest annual growth rate of any country, with an 18.6% increase in demand.

When it comes to exhibitions, one of the great strengths of Asia is its appetite and level of national support for business, commerce and innovation.

In industries like Manufacturing, Automotive and Technology, Asia is increasingly taking a leading position in the global supply chain, and this creates huge demand from businesses to connect with national and international customers, something exhibition platforms provide at scale.

This alignment is reflected in the rapid expansion of the exhibitions industry in the region.

China became the world’s second largest exhibitions market in 2015 and was valued at $2.7bn in 2017, growing at 11%. Part of this growth is thanks to the construction of new venues in tier two cities as well as expansion of existing venues in the country’s largest hubs. In late 2019, the Shenzhen World Exhibition & Convention Center is slated to open, which will ultimately offer over 500,000 sq. m of exhibition space, the largest single exhibitions venue in the world.

This commitment to exhibitions as a source of international investment is a trend being mirrored in other countries across Asia.

For example, both Thailand and Indonesia have formed a national Convention and Exhibition Bureau, specifically to provide active support for the exhibitions market.

In a region as large and diverse as Asia, there is not a one-size-fits-all model for a successful exhibitions operating approach but there are common factors that are important. Local relationships are critical, as individual markets have their way of doing things, from dealing with local authorities and trade associations, to collaborating with partners and managing suppliers. Having a strong and recognised brand also helps, as trust and reputation are key.

Perhaps the most important factor is attracting talent. Exhibitions is by nature a people business, dependent on the commitment and focus of individuals to bring brands to life. With the growth and innovation happening around us in other industries, attracting high quality talent into the exhibitions industry is not easy. One of the ways we are addressing this is through local partnerships; for instance, we have collaborated with the South China University of Technology to create a training base for future event professionals. In addition, our Asia operation is known for its internal training programmes which have proved successful in retaining and developing talent.

Margaret Ma Connolly, Informa Markets Asia CEO